August is here. Na-ghost ka na ba… ng accountant mo?

They stopped replying. No updates. No replies. No files. Just vibes.

You wait a day… then a week… Next thing you know, it’s BIR deadline season, and your books are still a mystery.

If this sounds familiar, breathe. You’re not alone—ghosting in the world of bookkeeping is more common than we’d all like to admit. But don’t panic. Here’s what to do next (and how to avoid getting haunted again).

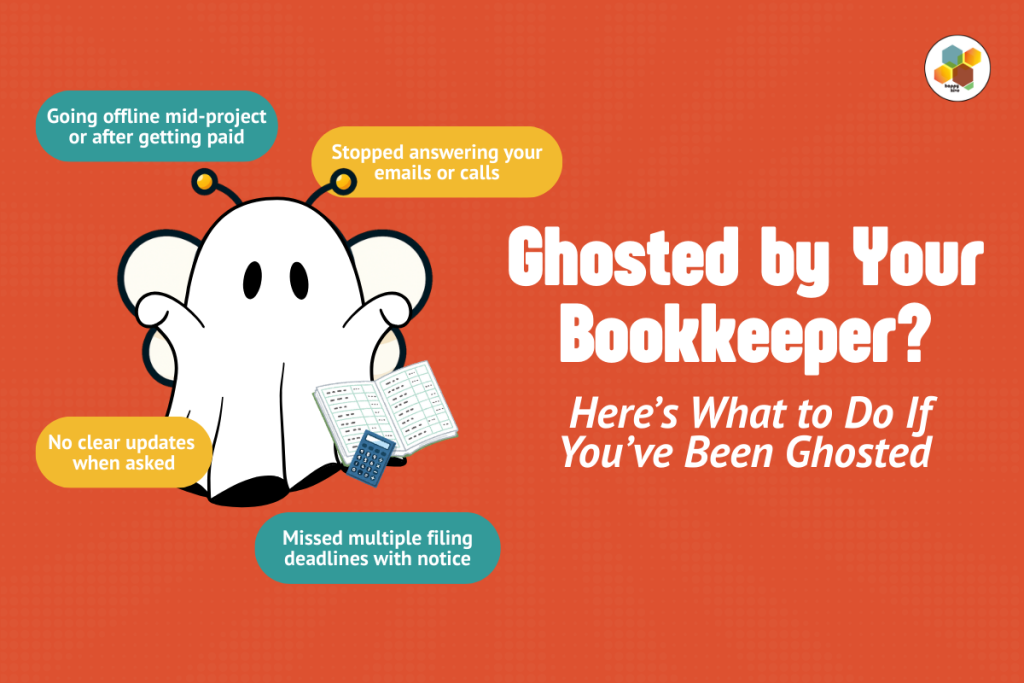

First, what does bookkeeper ghosting actually look like?

- They go offline mid-project or after getting paid

- They miss multiple filing deadlines without notice

- They stop answering your emails, chats, or texts

- They’re vague or evasive when asked for updates

- You never received your BIR forms or receipts—but they said “done na po”

Sound familiar? It’s scary, yes. But fixable.

Yup. Whether your bookkeeper disappeared, your pet ate your 1701Q, or your receipts got flooded, the penalties still apply.

You could be looking at:

- 25% surcharge on tax due

- 20% annual interest on unpaid amounts

- ₱1,000/month penalty for non-filing

- Suspension of your TIN or business permits (for repeated non-compliance)

A horror story. So what now?

Here’s What to Do If You’ve Been Ghosted

1. Try to retrieve all records.

Check your email threads, shared Google Drives, old receipts—anything you can find. Even screenshots help.

2. Log in to your eBIR/eFPS account.

Verify which forms (if any) were actually filed. If you have a Certificate of Registration (COR), list all the forms you’re required to submit.

3. Talk to a legit bookkeeper ASAP.

You’ll need someone who can assess: what’s been filed, what’s missing, and how much damage control is needed.

4. Catch up on missed filings.

Even if you’re late, file anyway. The longer you wait, the bigger the penalties.

How to Avoid Ghosting in the Future

- Ask for transparency. Regular updates, filing receipts, and access to your books are basic rights—not special requests.

- Check if they’re registered. Anyone handling your taxes should be registered with the BIR or part of a legit firm.

- Set clear timelines. Know what to expect and when. Get it in writing if you’re unsure.

- Don’t rely on one person. Look for services backed by a team—not just a freelancer juggling 20 clients.

Don’t want to deal with this again?

At Happy Hive, we clean up ghosted books, help you catch up on missed filings, and make sure you’re on track—penalty-free and ghost-free.

Need help?

Send us a message. We’ll take it from here (and we promise not to disappear—dito lang kami sa Matimtiman Street!)