Missed a tax deadline? Filed the wrong form? Or worse—forgot to file at all?

You’re not alone. But the truth is, tax penalties in the Philippines can snowball fast—especially if you’re running a business or freelancing solo.

Here’s a breakdown of common BIR and SEC penalties, how much they cost, and how to avoid them before they haunt your finances.

These apply even if you earned nothing during the period—non-filing is still penalized.

Common BIR & SEC Penalties (Philippines)

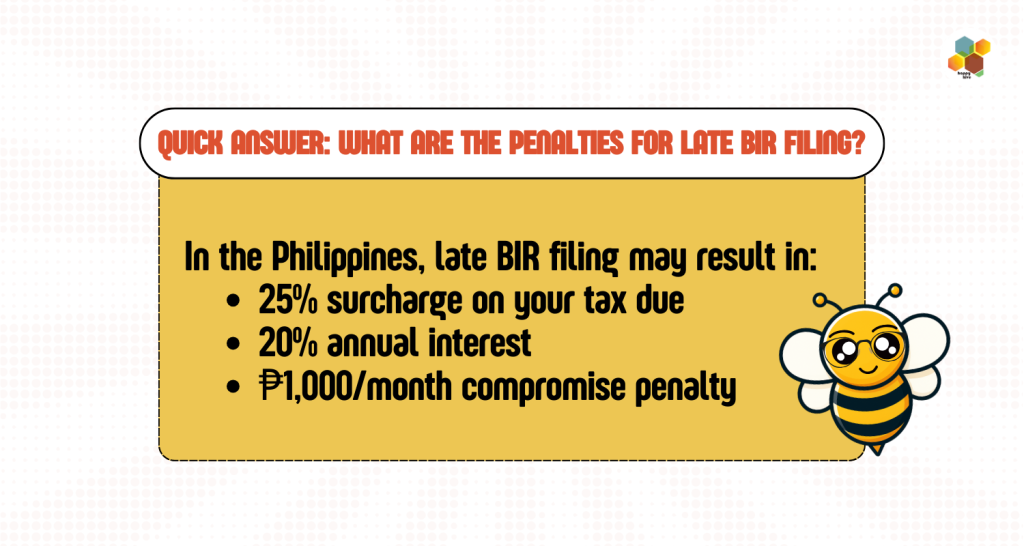

1. Late Filing with the BIR

If you file after the due date (monthly, quarterly, or annual tax returns), you’re automatically penalized.

Penalties include:

- 25% surcharge on tax due

- 20% interest per year

- ₱1,000 compromise penalty per return

Example: Miss a ₱10,000 tax payment? You could end up paying ₱12,500+ after just a few months.

2. Non-Filing of Tax Returns

Yes, zero income or no sales still requires filing. Skipping it can trigger a penalty—sometimes even system flags that can affect your TIN or business permit renewal.

Penalty:

- ₱1,000 per missed return

- May also trigger BIR notices or a tax mapping visit

3. Using the Wrong Tax Form

Filed a 1701 instead of a 1701A? Or submitted a VAT return when you’re not VAT-registered?

Risk: BIR treats incorrect forms as non-filed, which means you’re still charged late/non-filing penalties even if you filed on time.

4. Failure to Update BIR Registration (COR)

Switching from employed to freelance? Selling online? Expanding services? These changes require you to update your Certificate of Registration (COR).

Penalty:

- ₱5,000 to ₱20,000 for unregistered activities

- Risk of business closure during BIR inspections

5. SEC Filing Violations (for Corporations & Partnerships)

Corporations and partnerships must submit General Information Sheets (GIS) and Audited Financial Statements (AFS) annually.

SEC Penalties:

- ₱500 per day of delay

- Suspension or revocation of registration for non-compliance

How to Avoid BIR and SEC Penalties in the Philippines

1. Know your deadlines

Mark all BIR filing dates on your calendar. Don’t rely on memory alone.

2. File even if you earned ₱0

Even if you didn’t earn, the BIR requires zero filing. Skipping this still results in penalties.

3. Double-check your forms

Make sure you’re using the correct form for your income type, business type, and tax status.

4. Get professional help

When in doubt, hire a bookkeeper or tax compliance team (aka us!). One mistake can cost more than a year’s worth of fees.

Need Help Fixing a Missed Filing?

If you’ve already missed a deadline—or ten—don’t panic. Happy Hive offers penalty clean-up, late filings, and bookkeeping rescue for busy entrepreneurs and small teams.

Message us now. Let’s get your books back in order—minus the ghost stories.