So you’re a freelancer in the Philippines — setting your own hours, choosing your own clients, and working in pajamas if you feel like it. But while freedom is great, there’s one thing that always follows you, no matter where you work: taxes. (sad, ‘no?)

If you’re confused about your tax obligations as a freelancer, you’re not alone. This guide breaks it down simply so you can stay compliant, avoid penalties, and focus on doing what you do best.

Who Is Considered a Freelancer?

In the eyes of the Bureau of Internal Revenue (BIR), a freelancer is a self-employed individual earning income from services rendered outside of an employer-employee relationship

This includes:

- Virtual assistants

- Graphic designers

- Consultants

- Developers

- Writers and content creators

- Online sellers or service providers (earning above ₱250,000 annually)

If you’re earning from your skills or services — whether locally or from abroad — the BIR sees you as a taxpayer.

What Taxes Do Freelancers in the Philippines Pay?

Here are the main types of taxes freelancers may be required to file and pay:

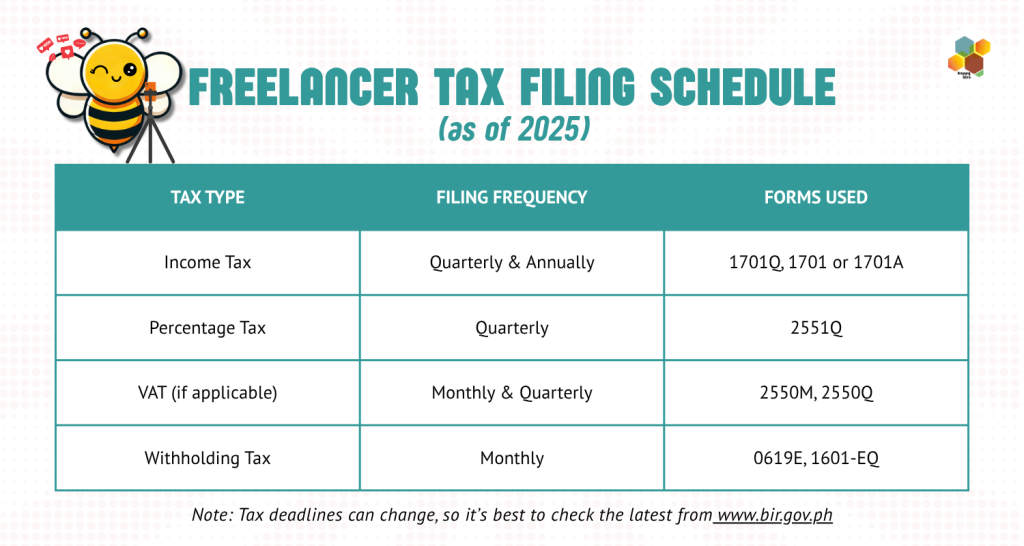

1. Income Tax

- Based on the graduated income tax rates (0% to 35%) or 8% flat rate on gross receipts if you qualify.

- If you earn less than ₱250,000 annually, you’re exempt from income tax — but you still need to register.

2. Percentage Tax (Non-VAT)

- Applies if you’re earning less than ₱3 million a year and not VAT-registered.

- Rate: 1% (until June 30, 2025, under the CREATE Law)

3. Value-Added Tax (VAT)

- Required if your annual gross receipts exceed ₱3 million.

- Rate: 12% of gross income.

4. Withholding Tax

- If your clients are registered businesses, they may withhold a portion of your income (usually 5% or 10%) and remit it to the BIR. This is credited to your tax due.

Freelancer Tax Registration: The Essentials

To pay taxes, you must first register with the BIR. Here’s what that process looks like:

Step 1: Prepare the Required Documents

- BIR Form 1901 (Application for Registration)

- Government-issued ID

- DTI Business Name Certificate (optional but recommended)

- Barangay and Mayor’s Permit (depending on RDO)

- Proof of address (e.g., utility bill or lease)

- Payment for Registration Fee (₱500) and Documentary Stamp Tax (₱30)

Step 2: Go to Your Assigned BIR RDO

Submit your documents and pay the fees. You’ll be issued a Certificate of Registration (Form 2303) and a notice to issue receipts.

Step 3: Register Books and Invoices

You’ll need to:

- Register your books of accounts

- Apply for Authority to Print official receipts, or

- Enroll in the BIR’s e-Invoicing system (if applicable)

Freelancer Tax Filing Schedule (as of 2025)

Here’s a basic filing calendar to keep in mind:

Tips to Make Taxes Easier as a Freelancer

- Save for Taxes – Set aside 10–20% of your income monthly to avoid cash flow stress during tax season.

- Know Your Deductions – Business expenses (internet, software, utilities, etc.) may be deductible.

- Consider the 8% Option – If you’re non-VAT and under ₱3M gross receipts, the 8% income tax rate might be simpler.

- Get Help if You Need It – An accountant or a business support service (uhm, hello? Like us!) can save you time and headaches.

Freelancing gives you freedom, but that freedom comes with responsibility, especially when it comes to taxes. The good news? Once you’re registered and familiar with your obligations, staying compliant is manageable.

And if you’d rather not deal with it yourself, Happy Hive Inc. offers tax registration and compliance services for freelancers, so you can focus on your craft while we handle the numbers.

Need help with BIR registration or filing?

Reach out to Happy Hive — we’re here to help you work smarter (and stress less).